The Difference We Make

Our agency is committed to helping our clients shop for insurance products based on their budget and health needs. We offer personalized service and ensure to provide plans that meet your specific requirements.

We understand the limitations of specific policies and do our best to ensure you’re educated on the same. We’ll provide you with the information and assistance you need, from premiums to deductibles to coverage periods.

Life Insurance

(Term and Whole)

Can’t decide between term life insurance and whole? At our agency, we’ll walk you through the various life insurance plans, educate you on everything you need to know, and help you pick the best plan that fits your needs.

Accident Coverage

Whether it’s a minor accident, like a broken arm or cutting your hand, or something major, like a broken back from a car accident, make sure your coverage protects your family and ensures financial stability in unforeseen medical emergencies. Please leave it to our experienced team to help you decide on the best policy for you.

Critical Illness Benefits

Having a critical illness doesn’t only affect you as an individual; it has a significant impact on the family’s financial situation as well. With a critical illness policy, families are granted a lump sum to cover medical and household bills.

Hospitalization Coverage

If you want to be protected from the high costs of hospitalization, make sure that your medical coverage provides the coverage you need. This coverage includes pre-hospitalization charges, post-hospitalization charges, ambulance expenses, and more.

Catastrophic Coverage

Be better prepared for worst-case scenarios and protect yourselves from unforeseen medical emergencies by ensuring you have catastrophic coverage. Reach out to one of our experts to learn more about the importance of this coverage.

Dental Insurance

Protect yourself from financial risk and invest in dental insurance. Dental procedures tend to be expensive; however, they’re often not covered in medical insurance plans. If you need help navigating through the various plans, get in touch.

Vision Insurance

From eye check-ups to contact lenses and eyeglasses to vision correction surgery, eye care comes with many expenses. If you’re looking to save on those costs, consider investing in vision insurance.

Short/Long Term Disability

Protect yourself and your monthly income from unforeseen circumstances resulting in short or long-term disability. If you’re not sure which plan is best for you, talk to one of our experts.

Medicare

Medicare is health insurance for people over 65 years old or individuals with certain disabilities. Our experts can help you explore the different parts that help cover specific services. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. It helps cover the cost of prescription drugs (including many recommended shots or vaccines).

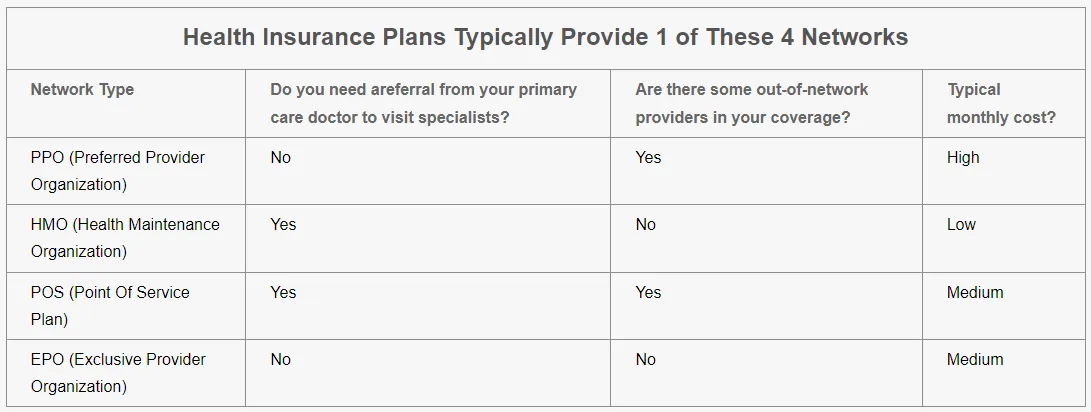

Some Major Types of Health Coverage

You can pick from different health insurance networks—EPO, HMO, POS, and PPO. These three little letters indicate what type of coverage you have. These networks will help you understand how your medical care, costs, and plan type fit together.

HMO

An HMO plan provides integrated care and places importance on prevention and wellness. It also tends to limit coverage to care from doctors or medical professionals who are under contract with the HMO. In to be covered, you will need to reside or work within its service region.

PPO

This is also a health plan in which you pay less if you use providers who are part of the network. Without a referral, you can see doctors, hospitals, and providers outside of the network for a fee.

POS

When it comes to POS plans, you’ll first need a referral from your primary care doctor before seeing a specialist. It’s the type of plan where you pay less if you stick to doctors, healthcare providers, and hospitals within the plan’s network.

EPO

This is a managed care plan where healthcare services are only covered if you use the plan’s network of doctors, specialists, or hospitals (except in the case of an emergency).

Common Health Insurance Terms

When discussing health insurance plans, it’s helpful to know some of the frequent terminology used. Here are some of the most used terms.

Deductible

This is how much you pay towards your medical bills before your insurance coverage kicks in.

Co-pay

Generally, you pay an upfront fee for doctor visits and prescription refills. This is known as a co-pay.

Co-insurance

This refers to the percentage of treatment costs you’ll have to pay after meeting your deductible. The amount is usually a fixed amount.

Premium

Your premium is what you’ll pay the insurance company for the privilege of having an active insurance plan.

Out-of-pocket maximum

This amount is the most you’ll pay each year toward costs, including your deductible, co-pay, and co-insurance.

Our Customers

Put You and Your Family In Good Hands

Phone

+1 (210) 981-4790

Hours of Operation

Monday 9 – 6 PM EST

Tuesday 9 – 8 PM EST

Wednesday 9 – 6 PM EST

Thursday 9 – 8 PM EST

Friday – Sunday Appointment Only

Copyright © 2024Knows Insurance | All rights reserved